Brace yourselves… Recession is coming.

What happened? And what’s next?

Post-COVID Recovery, Inflation and War in Ukraine.

Before we can address the obvious, it is important to describe the environment that led to the current state of things.

ON POST-COVID RECOVERY

Besides a month-long lockdown (in January), post-COVID activity in Toronto/GTA was very strong in the first quarter of 2022.

The number of real estate transactions surged to the levels we haven’t seen since the infamous 2017 real estate bull run (more on this topic later). All of this was driven by ultra-low interest rates on both residential and commercial sides of financing. With the cost of borrowing at an all-time low, everyone rushed to buy something.

Those who were in a position to qualify for financing this spring 2022, rushed to pull the trigger on a resale property. Others who were unable to qualify for financing at this time (employment too recent, lack of sufficient downpayment or credit, etc) couldn’t resist but look in the direction of pre-construction projects.

Ultimately, everyone did what they could to upsize an existing home or buy their first property while the cost of borrowing was in their favour. However, like all good things, this fine period of low interest rates is now officially over.

All of the conventional 5-year fixed rate mortgages on the AAA side of lending (think Scotia/TD/Manulife) have hopped over the 5% mark earlier in the month of June. With an almost guaranteed rate hike in the month of July or August, we are about to see the Bank of Canada Prime Rate enter the 4%+ territory for the first time since the 2000s. Following suit, all of the BBB lenders (the likes of HomeTrust/EquitableBank/etc) have priced their 1-year products at almost 6%. In a nutshell, all cost of borrowing across all lending channels appears to have literally doubled (if not tripled) from what it was just 6 months ago.

I remember us joking in the office (this must have been end of 2017) that the Stress Test (of 5.25%) introduced by the Feds was ludicrous since the rates we were selling were priced @ ~2% for 5-year fixed terms. And yet, here we are entering Q3 2022 with fixed rates on par or above the benchmark rate of 5.25%.

QUICK SIDENOTE:

This newsletter is not meant to promote my social media accounts, but i do encourage you to follow me online if you are social @thepocketbroker. I am most active on Instagram, but I can be found on Twitter and LinkedIn with the exact same handle.

SO, HOW DID WE GET HERE?

When the BOC (Bank of Canada) was predicting their inflation curve back in Q1 2022, the main goal was to catch it half way through the cycle (not too early to avoid slowing down the post-COVID recovery, but just in time before inflation got out of hand).

Little did we know, the World geopolitics had little to no regard for this post-COVID recovery or BOC’s hesitation to raise interest rates. At the end of February 2022, Russia invaded Ukraine triggering a plethora of economic and cultural sanctions from the West in an effort to stop the Russian invasion.

ON WAR IN UKRAINE

Those of you who know me a little better, know that the Russia-Ukraine crises is a conflict that’s rather close to my heart. While of mostly Ukrainian/Russian origin, my family got moved around U.S.S.R. quite a bit during the Soviet era. Most of my immediate family still lives in St.Petersburg and Vladivostok (Russia), while my less immediate family resides around the city of Odessa (Ukraine).

It’s important to recognize that Russian and Ukrainian people do not want to be at war with one another, but politicians have other agendas. Watching family members turn backs on one another over what they believe is true OR finding out about close friends who have lost their children to artillery fire has been rather heart-breaking to say the least. However, even as we grief the loss of those who perished, it is important to remember that wars are ordered by politicians (not the people).

As we witness one of the worst humanitarian crises unfold on the Ukrainian soil, Russian folks are finding themselves hopelessly trapped behind an iron curtain once again. Despite all things, I’m hopeful that the two sides can come to an agreement in the upcoming months. I am convinced that majority of Russian and Ukrainian people share my sentiment towards this topic.

However, people don’t order wars to stop, politicians do.

“War is a mere continuation of policy by other means”

– Carl von Clausewitz, On War

SPRING 2022 STOCK MARKET BUST & UNEMPLOYMENT

When the Ukrainian conflict broke out in February 2022, we were already experiencing higher than usual inflation. However, neither the U.S. nor Canada chose to raise interest rates in the months leading up to it.

Once the West enforced strict economic sanctions against Russia, it became quite apparent that whatever economic recovery we’ve seen since COVID was not going to be enough and it wasn’t going to last for long.

It was also unclear at first as to how long this conflict may continue. I think most of us were hoping that the nightmare would end tomorrow, but tomorrow never came.

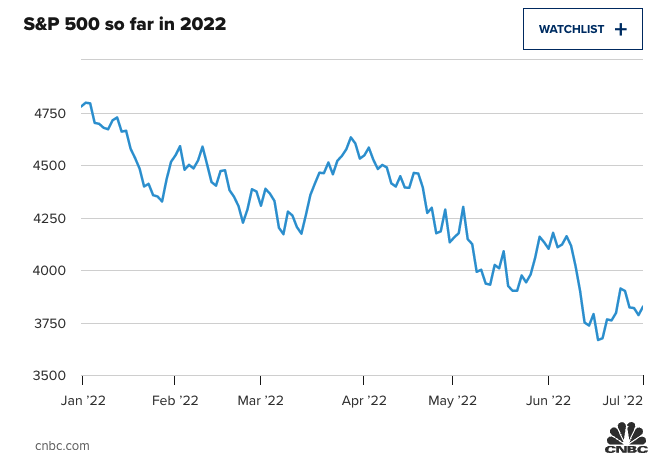

In just a matter of a few weeks, the stock market values started to crumble. With the Ukrainian conflict getting worse by the day and after taking the increasing energy and raw material costs into consideration, the stock market continued to sink (see the S&P 500 performance in the graph above + read more on its performance in 2022 here). The impact on the U.S. economy was so severe that the U.S. GDP (Gross Domestic Product) declined in Q2 2022 by a whooping 32.9% from just a year earlier (more on this topic here).

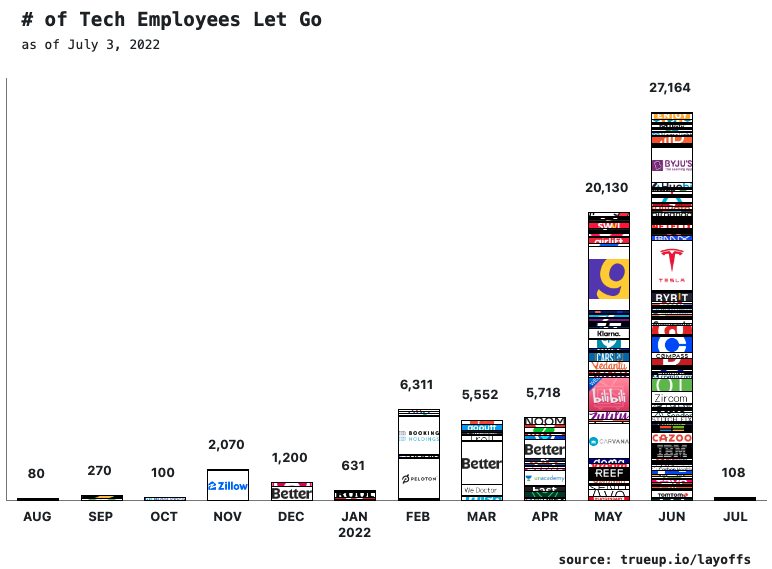

As more and more businesses found themselves less and less viable, layoffs in various industries began shortly after. The months of February, March and April 2022 saw the first wave of tech-layoffs from various small, medium and large companies (see the graph above). Nonetheless, the number of tech-layoffs that followed in the months of May and June make all three months of February, March and April 2022 look like child’s play.

However, it comes with no surprise that the tech sector would be affected greatly by the current state of things in the world. When you are expecting problems raising the next round of capital and inflation is breathing in your neck, you have to cut your losses as early as possible. Raising another round of capital during the upcoming recession does sound like a Sisyphean task. So the layoffs in this sector are expected and are likely to continue for some time (here’s more on this topic).

Other industries with significant layoffs were automotive & construction, but not nearly to the same extent as tech.

ON INFLATION IN CANADA

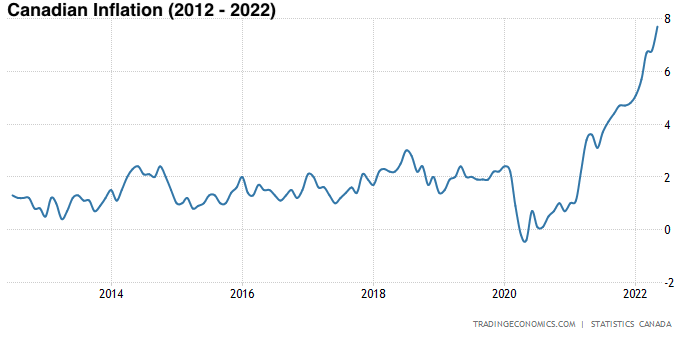

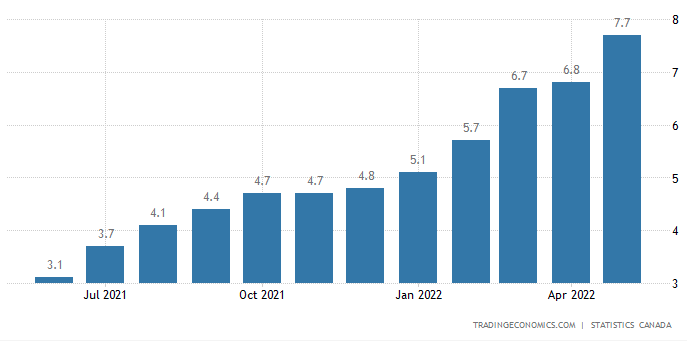

The rate of inflation in Canada was rather worrying ‘as is’ at the very beginning of Q1 2022. However, everyone’s worries got very real as soon as the Ukrainian conflict broke out. By July 1st 2022, some commodities (like food and gas) have gone up by 30-50% year-over-year.

The World Economic Forum website cites the following on their website:

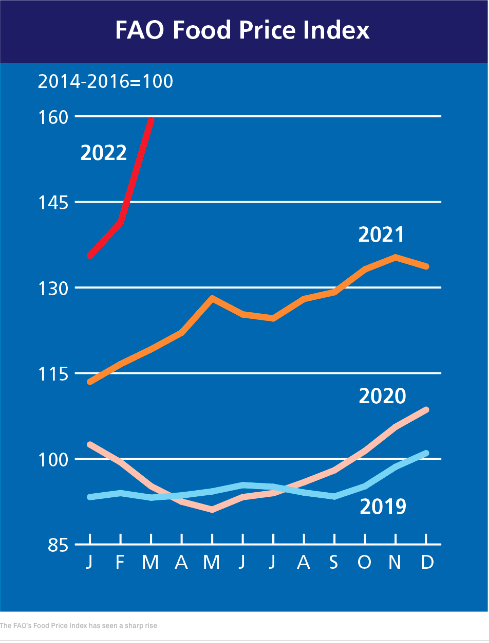

“Figures for March (2022) show a 12.6% increase in global food prices compared to February, the highest price levels recorded in the index’s three-decade history. Year-on-year comparisons show index prices increased by a third compared to March 2021.

The Russian Federation and Ukraine, combined, supply around 30% of global wheat exports and around a fifth of the world’s maize. Shortages of these and other commodities have destabilized global supply chains, sending food prices soaring.

The FAO Food Price Index measures the monthly change in global prices of a basket of food commodities (here’s a link to their website if you are interested in learning more).

I remember noticing the impact COVID had on food prices in 2020 and 2021, but these price adjustments came slowly over the course of multiple months.

Considering that the FAO FPI (Food Price Index) only references adjustments up-to the month of March 2022, I can’t help but get bothered by how steep the 2022 curve has been and how much it will likely move in the upwards direction by the end of the year.

HOW DOES ALL OF THIS RELATE TO REAL ESTATE AND MORTGAGES?

Let me start this section by saying that I’d much rather be optimistic and wrong, rather than pessimistic and right.

We’ve seen some incredible price action in Q1 (2022) across almost all real estate asset classes (condos/detached/semis/etc). All I kept hearing from Buyers in Q1 2022 was how little inventory there was on the market and how many bidding wars they lost to “an unconditional offer from someone else”. The overall 2022 purchase frenzy reminded me a lot of 2017 when the Real Estate market got so overheated that you couldn’t get a Seller to even look at your offer unless it was firm.

However, just a month after the slightest of changes in regulatory framework (introduction of the Foreign Buyers Tax + expansion of rent controls) the market froze. To make matters worse, one of the largest alternative Lenders in Canada (HomeTrust) was under review for fraud by the OSC (Ontario Securities Commission) and almost went out of business.

These things might not sound like much, but they turned the entire industry upside down in summer 2017. As Buyer’s confidence subsided in the months to follow, the number of Buyers dissipated. As Sellers started to panic, some decided to sell @ 10-20% discount from just a couple of months ago. Others terminated their listings and chose to wait things out. However, choosing to wait things out is somewhat affordable when your mortgage is at ~1.5 – 3.0% interest rate (as opposed to 5-6% rates we are seeing today).

Values kept sliding downwards for the rest of 2017 (I remember us getting an appraisal on a Mississauga home at $900k when it was sold for $1.25 million just a couple of months earlier). It was later in October that year that Canada introduced the infamous stress test to further stabilize its real estate market. As a result of these efforts, the real estate market got rather stagnant for the following 12-18 months, but eventually made a slow recovery to the Q1 2017 market values by 2019.

At the beginning of 2022, the Bank Of Canada (BOC) was well aware of how much the real estate market was overheating already. However, no rate hikes or regulatory changes came until March (when we saw a 25 bps increase for the first time since before the pandemic in 2020). By the time the rate increase came in effect, Canadian inflation was already running rampant > 5%. A lot of consumers started to look for ways to hedge their bets against such inflation. With the stock market taking a nosedive & cryptocurrencies tanking across all vendors, everyone turned their attention towards real estate once again.

However, the 25 bps increase clearly didn’t scare many buyers enough. In fact, March 2022 was probably the busiest March we’ve ever had at the Brokerage. Purchase activity continued without much slowing down and refinance activity picked up (as more homeowners were looking to expand their real estate portfolio).

However, as soon as the 2nd rate hike came out in April, it got everyone thinking. The most common question suddenly was “do you think there will be more rate hikes later this year?”. The number of purchases started to slow down and applicants looking to refinance were now more interested in setting up an emergency HELOC for a rainy day (as opposed to using equity take-out as downpayment for another property).

I must admit, last 60 days of real estate sales in GTA/Ontario (especially areas outside of major urban centres) looked very grim. We’ve already seen a whole bunch of properties that sold back in Feb/Mar not close, get re-listed and sold for 10-20% below their Feb/Mar price tag(s).

The most recent 50 bps rate hike from the BOC in the month of June was the last nail in the coffin. Not only did it squeeze a lot of the Buyers out of their respective pre-approved purchase ranges, but it almost entirely put purchase activity on pause for a few weeks.

IN CONCLUSION

Unfortunately, this upwards interest rate trajectory is likely to continue until some of the geopolitical and socioeconomic pressures are alleviated. In fact, 2022 may be the year we see AAA interest rates climb 6%+ for the first time since the 2000s.

As such, I am hopeful that the Ukrainian conflict gets resolved later this year.

I am hopeful that we (as an international community) resolve the food shortage issue before it becomes a bigger problem.

I am also hopeful that we can overcome these challenges before they cripple the U.S. and Canadian stock and real estate markets any further.

Thank you for reading until the end. These long-form reports are very time-consuming. However, I appreciate your time and attention to the matter.

P.S. Make sure to forward this message to anyone who you think could benefit from the information within. Sharing is caring.

Categories: Canada, Economics, Financing, Inflation, Rates, Real Estate