Pocket Mortgage Guide To: Bridge Loans

A bridge loan is a loan that is meant to carry the applicant financially between two transactions. Let’s say you are looking to both sell your home and buy a new one. You have found your ideal property and can afford it as soon as your current home sells. However, the dates between the two properties closing don’t match up as you hope. You need to finalize the purchase transaction before your home-sale funds are available. Is there a solution?

Yup, it’s called a bridge loan and it’s one of many products us mortgage brokers have in our arsenal. By bridging the two transactions you will be able to sell your home at a later date while using the equity within it to fund the purchase of the new home of your dreams.

Your current home must have a firm sale, when that is secured, the lender will have little issue facilitating (bridging) the two transactions. Once your old home transaction has closed, you just return the loan back to the bank + the cost of borrowing.

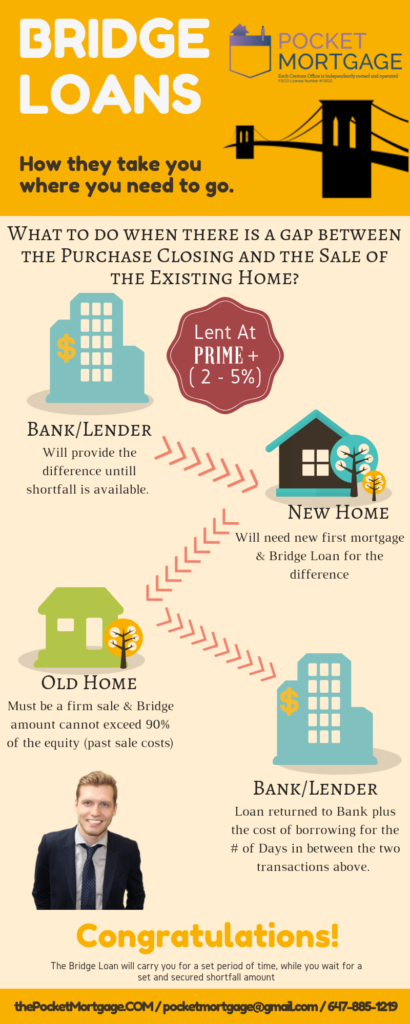

Here is an illustration that outlines the process: