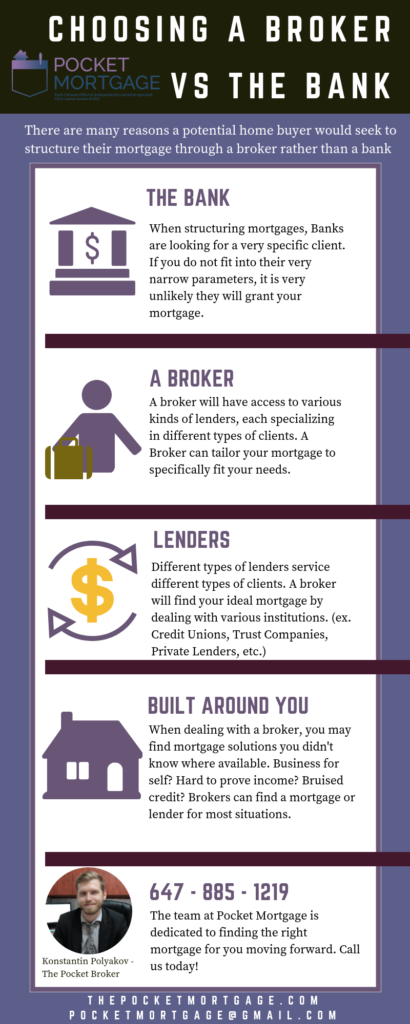

The Pocket Mortgage Guide To: Choosing A Broker Over The Banks

When structuring mortgages, Banks have set lending guidelines that are typically geared towards AAA business with little to no tolerance for anything irregular. If you do not fit into their parameters, it is unlikely they will grant you your mortgage.

However, there is an entire industry that exists to serve the market the banks choose to neglect. Business for self, new Canadians, damaged or bruised credit? People in these situations are more likely to find timely financing when dealing with brokers (who have dozens of lenders at their fingertips) than when dealing with a bank (with only a handful of products).

First of all, experienced brokers have access to an entire “menu” of lenders. They are not obligated or incentivized to sell only one particular brand or product. Unlike the big 5 banks, Brokers can sample different deals from across their network of credit unions, trust companies, or private lenders- to find the exact deal to fit your situation.

Second, brokers really work for you. Again they have little to no incentive to sell a particular product, it matters more that they find the right product to fit your exact scenario with the lowest possible cost of borrowing to you.

Lastly, Brokers are more willing to spend the time to get to know you, your file & establish a long term relationship. Rather than trying to fit each and every applicant into a narrow box, Brokers can see the full shape of the client’s file (growing family size, improving income potential, estate planning, etc) and can match them with the perfect deal across their network of lenders.

The team at Pocket Mortgage is dedicated to finding the right mortgage for you. Take the next step and give us a call today if you’d like to learn more on how we can get you the perfect mortgage to fit your pocket.