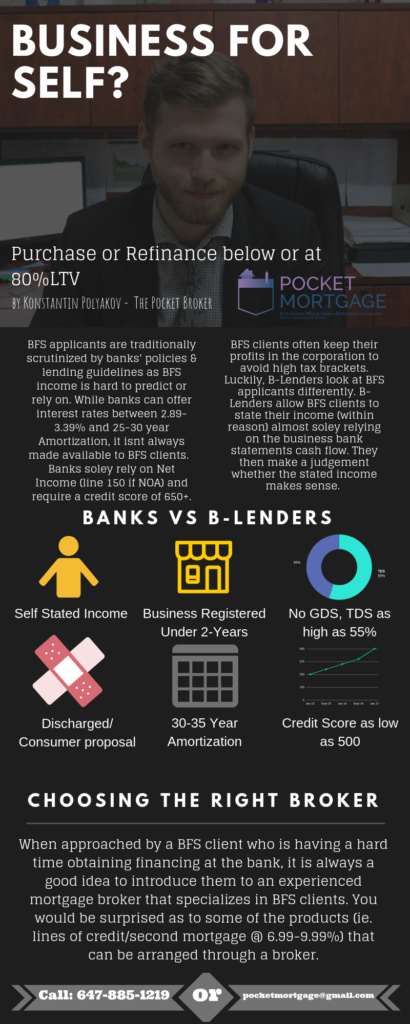

Pocket Mortgage Guide To: Business For Self Applicants

Many Business For Self (BFS) applicants will be in for a hard time when applying at a traditional bank. The majority of banks are typically risk averse, and as an entrepreneur, they see you as a risky proposition. Typically, the traditional big 5 banks are reserved for dealing with clients who can provide verifiable sources of income. However, those are not the only options.

As an independent brokerage we have access to 40+ different institutional and private lenders. These lenders are more than willing to look deep into your BFS story, and are able to make sense of your income in more than just one way.

Some of the unique specialties we are able to service are; self-stated income, businesses registered for under 2-years, past discharges or consumer proposals, low credit scores (as low as 500) and non traditional sources of income (tips, commissions, seasonal).

Here’s a visual illustration of some of the things described above.

Business For Self customers are great Pocket Mortgage customers